The following text is from a booklet published by the Federation of Netherlands Societies Ltd. in February 1985. The research for this booklet was done by Mijntje Hage.

The difficulties of the ‘first’ assisted immigrants were many, “housing” being one of the greatest problems. Although in post-war Holland housing was difficult to come by, eventually, if one was patient enough, the government would look after you. Not so in Australia, where capital was so scarce that even Australians themselves found it almost impossible to get finance for housing. The various Netherlands societies, confronted with the challenges of their created to provide financial assistance to Dutch immigrants in Australia to build or buy their homes.

The Netherlands Government, from the beginning of the post-war emigration programme, accepted the responsibility of assisting their emigrants to find jobs in Australia and in 1958, in view of the shortage of finance for housing, additionally moved to assist their emigrants financially to obtain adequate housing.

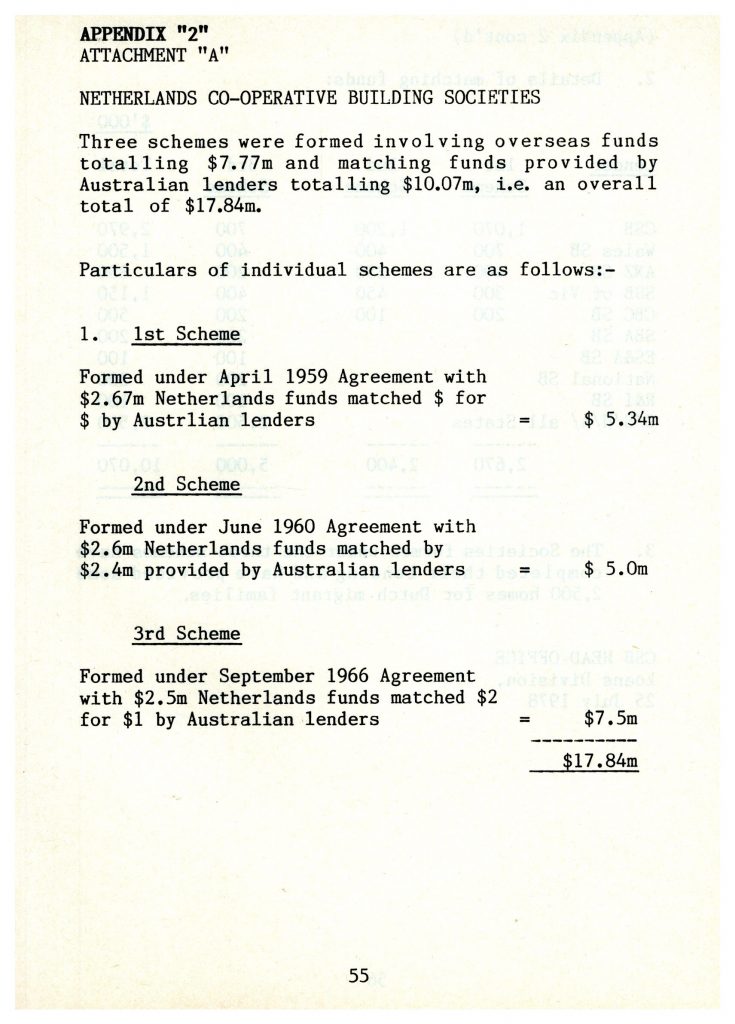

In August 1958, at the suggestion of the Australian Government, representatives of the Netherlands Embassy in Australia approached the then Governor of the Commonwealth Bank, Dr H.C. Coombs, with the news that their Government had been successful in negotiations with the U.S. Development Loan Fund for a loan on $A 2.67 m. to house their emigrants in Australia. The loan was granted on the condition that the $ 2.67 m. be matched dollar for dollar by Australian savings banks. The Governor was asked for assistance in implementing the loan.

The Commonwealth Savings Bank, in view of its experience in lending for housing, was nominated to act as Agent for the Netherlands Government in the disbursement of the overseas funds and to arrange the matching Australian funds; the Bank was also requested to devise a scheme by which the total funds involved of $ 5.34 m. could be lent to Dutch immigrants.

The CSB accepted the role of Agent under an agreement executed in April 1959 for a nominal service fee of 0.25% on the outstanding balance of the overseas loans. There were of course a number of complex technical and legal problems to be solved, including the exchange risk on the overseas funds, but the bank was able to overcome the difficulties. It was decided the best and most efficient way to disburse the funds was through State Government guaranteed terminating co-operative building societies in the various states in which such societies operated. The State Government Guarantee was an attractive factor to the Netherlands Government.

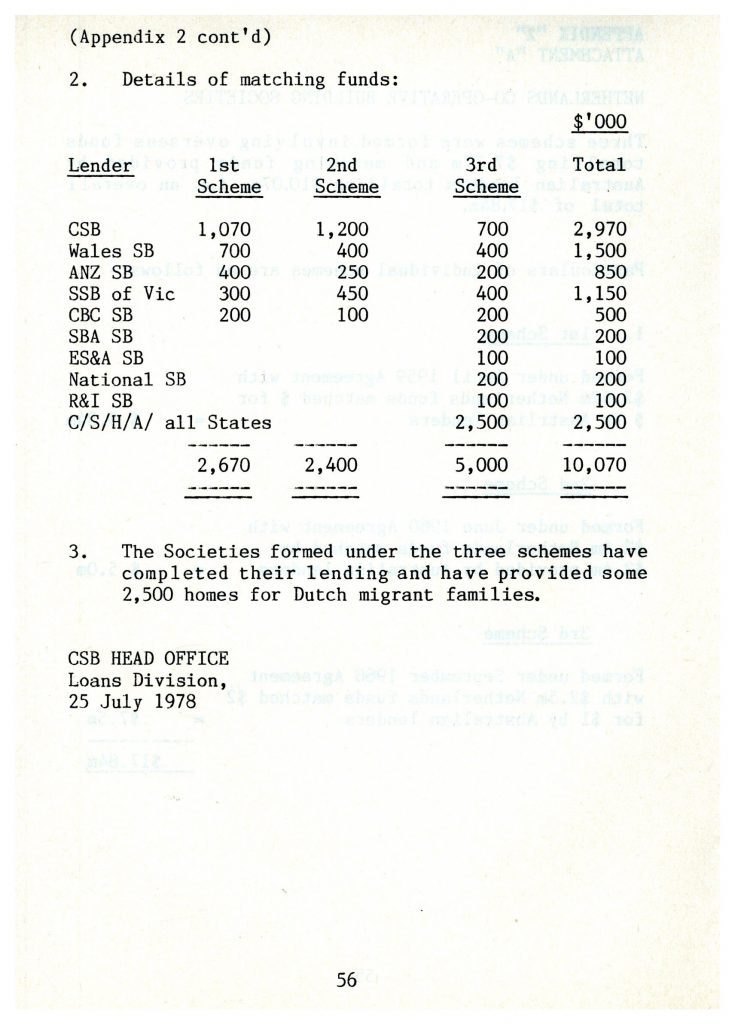

With regard to the matching Australian funds of $ 2.67 m. required, outstanding and instant cooperation was displayed by four other savings banks when approached by the CSB to form a consortium to provide the funds, the result being as follows:

- Commonwealth Savings Bank: $1,070,000

- Bank of N.S.W. Savings Bank: $700,000

- ANZ Savings Bank: $400,000

- State Savings Bank of Victoria: $300,000

- CBC Savings Bank: $200,000

- Total: $2,670,000

In 1960, a second scheme was formed involving the same banks, and an overall amount of $5 million (including matching funds) was quickly disbursed.

A third and final scheme was implemented in September 1966, this time involving an overseas amount of $2.5 million from The Netherlands and on the basis that this amount was to be matched on a $2 to $1 formula as against the previous dollar for dollar.

To provide the extra $2.5 million, the CSB on behalf of The Netherlands Government approached the various State Governments which readily agreed to provide the required matching funds under the Commonwealth/State Housing Agreement. This was considered fully justified in view of the ingredient of self-help contained in the proposal and that by joining in the scheme, overseas funds of $2.5 million would be engendered into the Australian economy for housing, of which there was a grave shortage.

On this occasion, nine savings banks joined in the consortium to provide the matching funds of $5.0 million.

The three Netherlands schemes combined, provided an overall amount of $17.84 million as set out in Attachment “A”. The schemes are unique in Australia and their outstanding success is a great credit to all concerned.

So far Mr. Conley. For a complete resume of the three schemes, see below. When one realizes that the average family who received a loan under the schemes consisted of father, mother, and four children, some 15,000 individuals benefited from them.

For a complete resume of the three schemes see Appendix 2. When one realises that the average family who received a loan under the schemes consisted of father, mother and four children, some 15,000 individuals benefited from them.

Below is appendix 2

Documents from the DACC Archives Box 106/2

The DACC archive folder on the Netherlands co-operative terminating building societies, as stored in Box 106/2, also includes a number of generic Australian government documents:

- NSW Model Rules of a Co-operative terminating Building Society, published in 1937

- A generic rules booklet with additional information from the Netherlands Co-operative Building Society 1965?

- Circular no 29 to Termination Building Societies with Government Guarantee 30-9-1954

- Abstract from ‘Our Home” March 1955 – Advice re Investment in Bricks and Mortar

- Instructions for lodging application (2 documents)

- Form of model rules

- Form on the Basis of Operation 1955

- Form (empty) for list of members

- Form (empty) for list of directors

- Information sheet on the Formation and Registration of a co-operative society in NSW

- Form (empty) “Memorandum of Mortgage”

- Form (empty) “Application for loan”

- Standard Rules of Co-operative Housing Societies being financed with Government Guarantee

In the DAW below see page 12 for an article on the Building Societies. Indicating that in 1991 the Building Societies were dissolved. Remaining funds were transferred the the Queen Wilhelmina Benevolent Fund